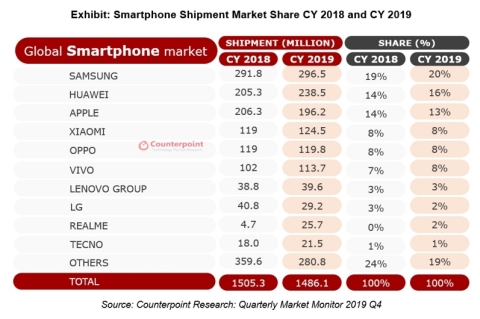

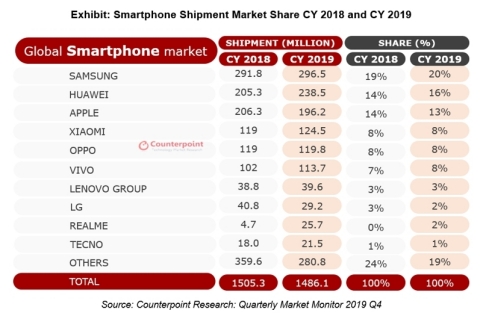

SEOUL, South Korea & HONG KONG & NEW DELHI & BEIJING & LONDON & BUENOS AIRES, Argentina & SAN DIEGO--(BUSINESS WIRE)--The global smartphone market declined 1% YoY in CY 2019, according to the latest research from Counterpoint’s Market Monitor service. This is the first time that the smartphone market has declined for two consecutive years. However, the decline was slower than in 2018 (4% YoY). The smartphone market actually grew 3% YoY in Q4 2019, indicating signs of a recovery and is expected in 2020.

2019 brought both innovations, 5G, folding displays, but also an uncertain trade and political climate. Commenting on the global market dynamics, Tarun Pathak, Associate Director at Counterpoint Research noted, “There have been growing tensions among several countries that have impacted the smartphone market. For example, the US pressure on Huawei, and tensions between Japan-Korea that led to uncertainties in the memory market. Supply chains have been upset, causing various companies to rethink their strategies and reduce dependence on single markets. 2020 will likely see efforts to further diversify investments across geographies to mitigate risks. The current Coronavirus outbreak in China is the latest issue to threaten supply chains.”

Despite the sanctions, Huawei surpassed Apple to become the second-largest brand in 2019 driven by aggressive push from Huawei in the Chinese market, where it achieved almost 40% market share. Within the quarter however, after two-years, Apple gained the top spot in the Global Smartphone Market. This was driven by the iPhone 11 series beating expectations.

We also saw smartphone brands changing their strategies in 2019. For example, Samsung revamped its A series, giving a push to the mid-segment. Apple launched its iPhone 11, with multiple cameras, at a lower price than its predecessor. 5G also provided an opportunity for OEMs to gain mindshare by launching industry-first “5G-capable” devices in markets that were early to launch 5G services. 2020 is expected to be the breakout year, with 5G smartphones poised to grow to around 18% of total global smartphone shipment volumes in 2020 as compared to 1% in 2019.

For a more detailed analysis click here