Selling a new smartphone is the hardest it has been in years. Rising device costs, limited differences between model upgrades, and economic and environment-related desires to keep electronics alive as long as possible are making people turn to refurbished phones, data shared this week by analyst Counterpoint found. And if someone is buying a refurbished phone, there's a good chance it's an iPhone.

According to Counterpoint, Apple represented 49 percent of refurbished phones sold worldwide in 2022. The number of refurbished iPhones sold increased 16 percent year-over-year, with the overall used smartphone market growing 5 percent year-over-year, Counterpoint said. The numbers would be even higher, but a reported 17 percent drop in refurbished smartphone sales in China—driven, the firm said, by an increase in COVID-19 cases and related policies—was detrimental.

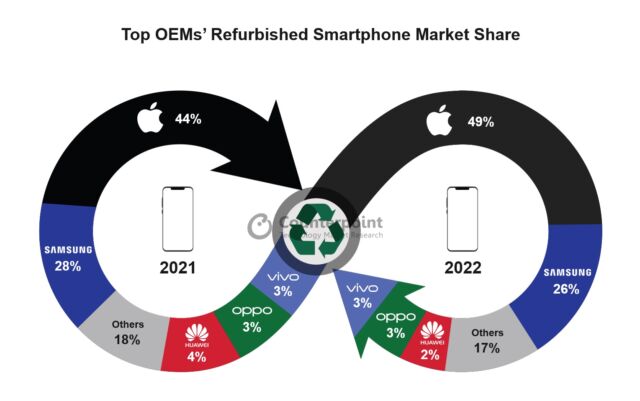

By Counterpoint's measures, Apple grew its market share here from 44 percent in 2021 to 49 percent. Samsung is the biggest competitor, but it lost market share.

Counterpoint said Android users switching to Team iOS in 2022 was a factor that "will likely continue" this year.

iPhones are thriving in this area, partially because it's easier to make money reselling a certified, pre-owned-grade iPhone than it is other devices, Counterpoint Research Director Jeff Fieldhack said in a statement shared with the analyst's announcement. iPhones are also popular among refurbishers because they can sell for more. For example, Back in the Box, which refurbishes and sells phones and other electronics, recently told The Wall Street Journal that it prefers iPhones to Android devices, largely because "Apple updates device software for more years than its competitors do," according to the WSJ.

Because Apple products are expensive, used or refurbished alternatives are popular with shoppers looking to save money but stay in Apple's ecosystem. Used iPhones and other products don't have the same warranties as new devices, but customers who buy refurbished Apple products from Apple directly, for example, can see a limited warranty and purchase AppleCare protection to make the purchase more secure.

According to Counterpoint, in mature markets like the US, 2022 demand for refurbished smartphones mostly came from people seeking a new phone, compared to emerging markets, where demand came from people looking to upgrade from a feature phone.

Refurb’s reputation

A new trend the analyst highlighted is that customers more frequently turn to used phones to save money on high-end flagship devices. Meanwhile, used phone sellers have successfully improved the customer perception of used devices through marketing.

Many are pushing trade-ins by offering customers credit. IDC predicted that in 2023, shoppers would see "more generous trade-in offers and promotions." We've seen this start coming to fruition with the likes of Apple increasing trade-in values for some iPhones (iPhone 13 Pro Max, 13 Pro, 12 Pro Max, and 7 Plus) in March. A few weeks later (and right before Earth Day), the company launched a more informative trade-in website with a new look, as noted by 9to5Mac.

reader comments

91